Search for A Safe Place to Live is A Fast Growing Trend

The value of having a secure and stable place to live, is a privilege many of us overlook and undervalue. Having a safe place to live in peaceful retirement, or to grow a family and prosper, is a priority. Attaining this security is a growing concern for people in a growing number of locations, as global geo-political tensions increase daily…. The investment in a secure place to live is gaining a higher priority ranking in financial planning for a growing proportion of the world’s affluent population.

My friend Shazia is a good example. Her husband’s parents are looking for alternative residency due to recent border tensions in their home country. For many people enduring this dilemma, the solutions are to obtain residency in a different country, or to obtain a second passport.

Citizenship Programs: Unusual ‘Investment’ Characteristics

For 2nd passports, thankfully there are many options available, but only if n applicant possess a fairly substantial capital sum, in the range of $200,000 or more. These solutions are referred to as Citizenship by Investment Programs (CBI or CIP). As an investment, these programs have characteristics that are not commonly associated with the term ‘investment’.

- The first characteristic is the immediate capital write down that occurs as a result of donations or other non-refundable contributions to the recipient nation.

- The second characteristic is the high fees paid to advisors, often lacking in transparency and disclosure.

- Due to the cross-border nature of the transaction, and competing, conflicting national interests, there is little regulatory protection for investors.

Good Program Design Attracts Investors

Among the most successful of these citizenship programs in the last 12 months has been that of the Republic of Turkey, in terms of the number of new passports granted. The success is due to a combination of factors;

- The application process is simple and approval is practically risk free.

- The capital allocation required is low, at $250,000 for a real estate purchase, or $500,000 for bank deposits, government bonds, venture capital funds or REITS.

- The capital write down is among the lowest available, at zero: there are no donations and non non-refundable contributions….

Quality of Service: Advisory Consultants

Knowing of my experience with Turkish real estate, my friend Shazia reached out for my support, in response to advice received from CIP consultants, about Turkey’s Program. I agreed to do a little research. We were all surprised by the results. Of 20 CIP consultants selected from the top internet search engine rankings (including top tier international consulting firms), my survey results are as follows:

- 85% would only provide information about the real estate investment option, and not the alternatives of bank deposits or government bonds etc

- 90% of those would not provide meaningful transparency regarding due diligence on the real estate (checking prices, permits, liens, appraisals, payments and other precautions).

- More than 70% instead advised ‘we have done hundreds, don’t worry, there isn’t any risk…’ (in other words, ‘trust us’…)

- More than 80% were incapable of providing information about Turkish Lira currency devaluation rates, or property price history trends in Dollar or Euro terms.

- New passport application processing fees charged by advisors for real estate investors range from $2,500 to $7,000, but for investors in bank deposits, etc the fees range from $6,000 to $15,0000.

- Less than 5%: only one provided website and email links to Turkish government agency websites for Turkey's Citizenship Investment Program via Real Estate Purchases, Fuds, Bank Deposits, etc, which provide multiple sources of clear and accurate disclosure.

These results suggest the quality of service provided by advisors in the CIP / CBI sector is of a wider variance and significantly below standards generally to be expected for ‘investment’…. From the successful result of Turkey’s Citizenship by Investment program, the quality of advice is obviously not a factor deterring investors.

Due Diligence is Essential: Caveat Emptor

However, as a professional, and with friendly concern for my friend Shazia, I ventured further with my own due diligence. My curiosity was piqued by the fact that advisors were charging considerably higher fees for bank deposits than for real estate investment, despite real estate requiring far more work and expense.

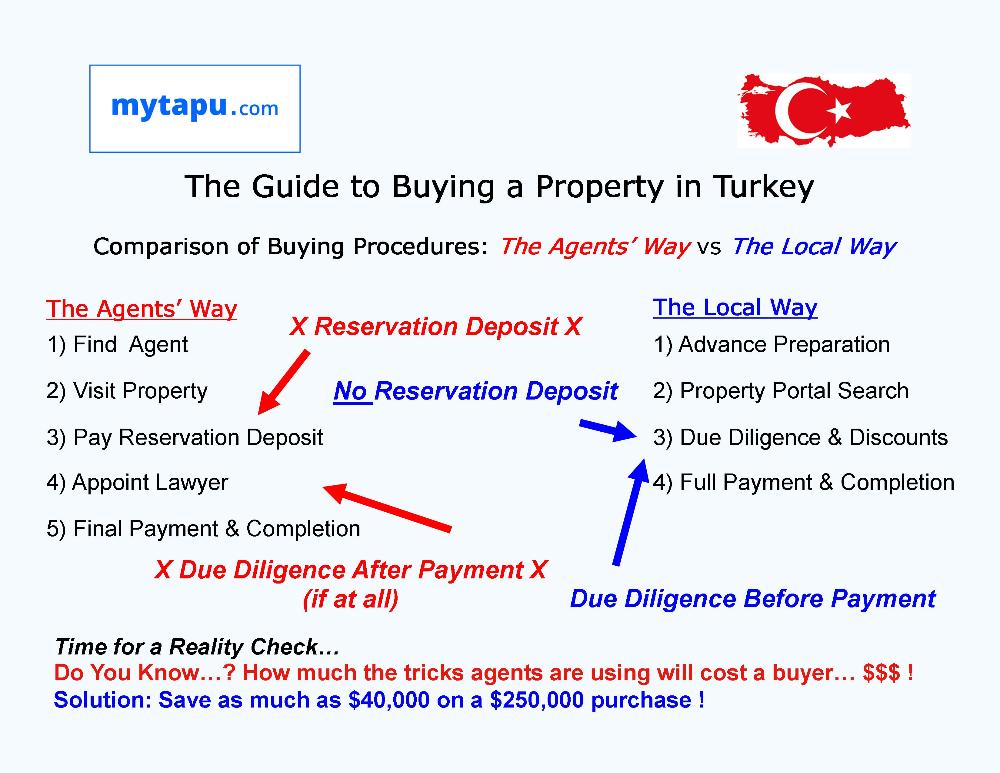

Finding the explanation did not take long…. On real estate purchases, the advisors receive non-disclosed profit sharing amounting to as much as 20% of the property sales price. In other words, there is a capital write down that is not evident to the investor until after the three year duration of the required holding period. A very clever program design feature it may be, but not a very clever use of an investor’s capital. Presumably most investors that have participated are not aware of this. That presumption also proved inaccurate, because this fact is widely lambasted on both Chinese and Arabic speaking social media. Evidently the consultants and attorneys participating in these schemes and advising enquiring investors smugly on the merits of real estate investment, imagining the investors know no better, appear a little disingenuous. And foolish too, considering they are fooling few other than themselves….

For Shazia’s family the search for solutions continues, now fortunately aided by an advisor that has lived in the locations he is advising about, and also understands the value of protecting investors and their capital… a trait that is sadly absent in this investment sector, and notable for that reason…

住宅房地产投资伊斯坦布尔土耳其

आवासीय अचल संपत्ति निवेश istanbul टर्की है

no tax citizenship investment istanbul turkey

免税公民投资伊斯坦布尔土耳其

कोई टैक्स नागरिकता निवेश इतनबुल टर्की नहीं है

#citizenship #investment

#immigration #CitizenshipInvestment #Turkey #CitizenshipbyInvestment

#bankdeposits #governmentbonds #PropertyTurkey #RealEstate #currencyrisk #TL

#risk #cip #cbi #citizenshipinvestmentturkey

#2ndpassport #notax #immigrationservices #residency #residencybyinvestment

#businessinvestor #realestateinvestor #passports #turkey #citizenshipbyinvestment #immigration #residency #passports #turkish #travel #tax #2ndpassport #citizenship #immigration #taxlaws #InvestmentstrategyTurkey #RealEstateResearchTurkey #RealEstateResearchIstanbul #IstanbulInvestmentstrategy #mytapu

#investturkey #citizenshipinvestmentTurkey

#Turkey #foreigninvestmentpromotion

2-ші төлқұжаттар азаматтық инвестициялау Түркия2de paspoorte burgerskap belegging turkiye

#第二本护照 #公民投资土耳其 #伊斯坦布尔 2-ші төлқұжаттар # 2-й паспорт гражданство-Турции-инвестиции # 2 ਪਾਸਪੋਰਟ ਨਾਗਰਿਕਤਾ ਨਿਵੇਸ਼ ਟਰਕੀ नागरिकता निवेश तुर्की दूसरा पासपोर्ट

2 جوازات السفر 2nd پاسپورٽ 2ھريت سيڙپڪاري

ترڪيدوسرا پاسپورٹدوهم پاسپورټونه المواطنة الاستثمار تركيا د تابعیت پانګه ترکیه

سرمایه گذاری شهروندی ترکیهشہریت کی سرمایہ کاری ترکیپاسپورت 2

.jpg)